Human movement data, or human mobility data, is a powerful source of insight into how people move, where they shop, and more. By studying human movement patterns, brands can power growth through insights on consumers’ interests, profiles, and pain points.

Today more than ever, brands need actionable, real-time insights that can enable decisions as the world reopens. To glean truly actionable insights, brands must combine both online and offline behaviors of their consumers to arrive at real-world intelligence. Human movement data provides brands with insights into their consumers’ brand affinities, shopping habits, favorite apps, hobbies, and more, while also revealing their real lifestyles and consumption patterns.

In this blog, we look at how retail brands can use human movement data, an enriched form of mobile location data, to make better decisions and drive growth.

When it comes to the retail sector, understanding consumer behavior, home and store locations, demographics, and more, are crucial factors for success. To illustrate the possible use cases for mobility data, we did a comparative study of grocery shoppers in Turkey visiting different kinds of stores including supermarkets, hypermarkets, and smaller grocery stores.

Methodology

In this report we studied:

- Monthly unique visitors to Grocery Stores, Supermarkets, & Hypermarkets in Turkey

- Types of audiences seen at these stores (Age, Gender, & Profile) along with their visit frequency

- Home locations of consumers visiting these specific stores (anonymized data)

- Trade area maps & top locations visited during weekends, & evenings by the consumers

1. Demographic Insights

Age Group

Profile

(Ages and Profiles of Visitors to Grocery Stores in Turkey)

Across the study locations, we found a few key trends in the demographics visiting each category:

-

- People from the Affluent and Parent categories showed a preference for Hypermarkets.

-

- Men preferred hypermarkets over the other two types, while women preferred supermarkets followed by smaller grocery stores.

-

- The 25-34 audience preferred hypermarkets over other stores compared to the other age groups, while the 35-44 were seen at all three types of stores. Together, both these age groups comprised the majority of grocery shoppers.

2. Visitation Patterns: Weekday vs Weekends

Grocery Stores

Supermarkets

Hypermarkets

(Weekday vs Weekend Visitation to all three categories)

The study locations saw similar patterns of weekday vs. weekend shopping behaviors, with some nuanced differences between categories:

-

- The weekdays were the peak visitation times for all three kinds of stores

-

- Grocery stores attracted comparatively more visitors during weekends.

3. Cannibalization (both same brand and competition)

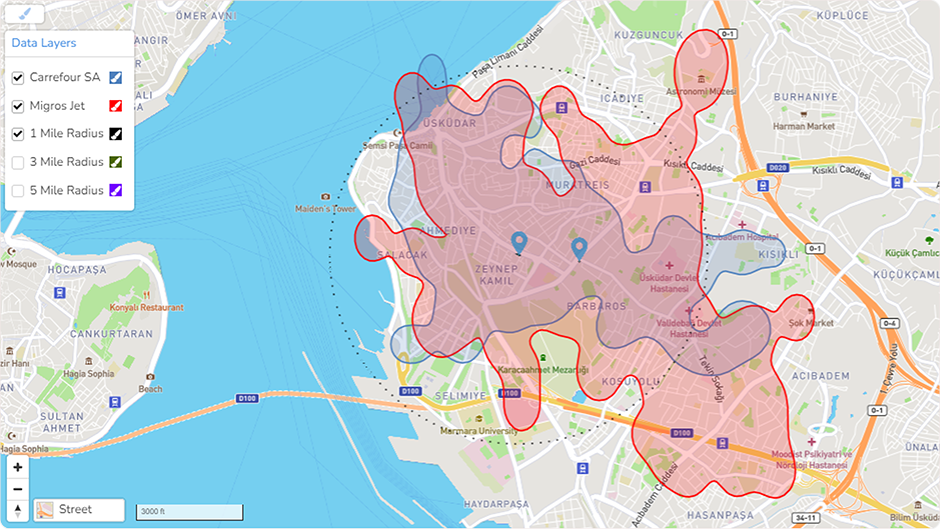

Human movement data also helps brands with market coverage optimization and selecting optimal locations. We analyzed two popular brands in Turkey, Carrefour and Migros, to see how their trade areas overlap and how far their consumers are willing to travel to shop at their stores.

(Trade area overlaps between competitors (the blue pins represent the location of the stores))

The data revealed that the Carrefour Super SA store was able to generate the majority of its customers from within a 5-mile radius. While Migros Store was able to capture the customers from within a 3-mile radius. Their trade areas also overlap significantly.

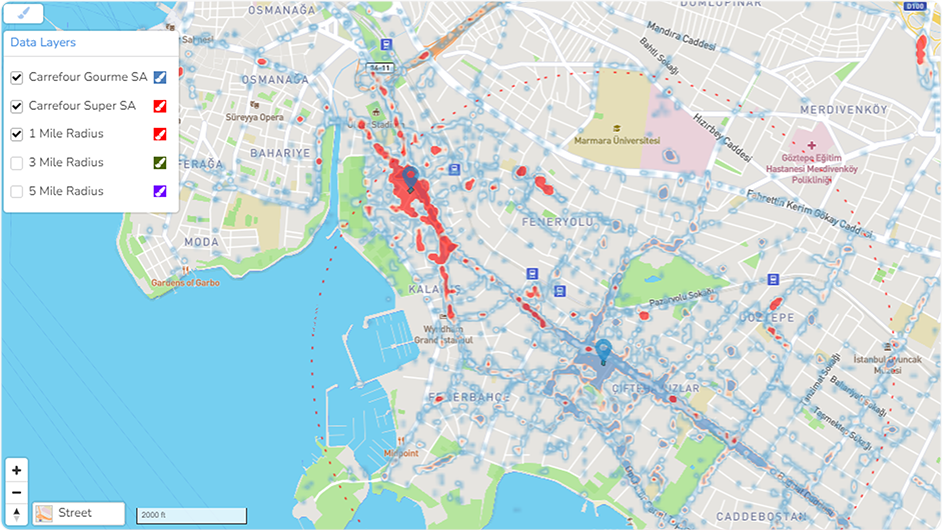

(Trade area overlaps with stores of the same brand (the blue pins represent the location of the stores))

While using location data to choose optimal locations based on competition is important, it is also important to ensure there is minimal overlap and cannibalization in trade areas for same brand stores. We studied the overlap of two brands under the Carrefour banner: Carrefour Gourme and Carrefour Super. The data reveals that more than 90% of Carrefour Gourme SA store’s market is being cannibalized by its other brand, Carrefour Super SA.

4. Pathing Reports

Pathing reports provide detailed information about the route the consumer took to visit the store, visualizing where they were seen for a specified time before and after their visit. Pathing reports show where devices were seen before they visited a location being studied or where they went afterwards.

(Pathing report for consumers visiting Carrefour Gourme SA stores (the blue pins represent the locations of the stores)

The pathing report for consumers visiting Carrefour Gourme SA stores revealed that they were mainly seen on Bagdat Cd. before & after visiting the store. With this insight, Carrefour could focus on advertising offers/discounts at this specific spot to attract more visitors. This information also helps operational leaders plan better for future expansion such as adding more store locations or planning warehouse delivery routes.

5. Home Locations

Understanding where consumers live can help brands understand their likes and dislikes, shopping habits, and travel preferences better. Home location data can provide crucial insights while selecting site locations, optimizing marketing targeting, planning delivery routes, and more.

(Home locations of the Migros store consumers)

For home locations, we studied consumers who visited a Migros store over three months to understand where they lived and where they traveled from to visit the store. The red color pin represents the location of the grocery store and the clusters represent the number of customers residing in that area. As you can see, the largest groups of customers are coming from highly populated areas of Istanbul near the store, while some smaller populations came from more suburban areas on the outskirts of the city.

These are only a few of the various use cases on how human movement data can be applied to the retail industry. These insights enable brands to understand their consumer better and make informed decisions when it comes to marketing strategy and operations. In a world of rapidly evolving consumer behavior and shopping trends, insights from human movement data can provide a key competitive advantage.