How has visitation to grocery stores changed during the COVID-19 pandemic, on a national, regional, and local level?

As our society settles into the “new normal” of social distancing directives and shelter in place orders due to the COVID-19 pandemic, the shopping patterns of consumers are changing, often in the cadence of news cycles.

This “new normal” will have a lasting impact on how, where, and when consumers shop and brands will have to adjust to the changing landscape.

By utilizing grocery store chains on a national, regional, and local level as a use case for our analysis, we are able to quantify changes in consumer behavior before and during the COVID-19 pandemic.

Identifying and understanding changes in consumerism during this time can help businesses plan marketing, business, and recovery strategies once the economy reopens.

Objective

Our objective is to quantify the impact COVID-19 has had on visitation among grocery store chains.

Analysis

National grocery store chains – time of day and day of visit are changing

Visitation to grocery stores peaks once a week, shifts one day earlier

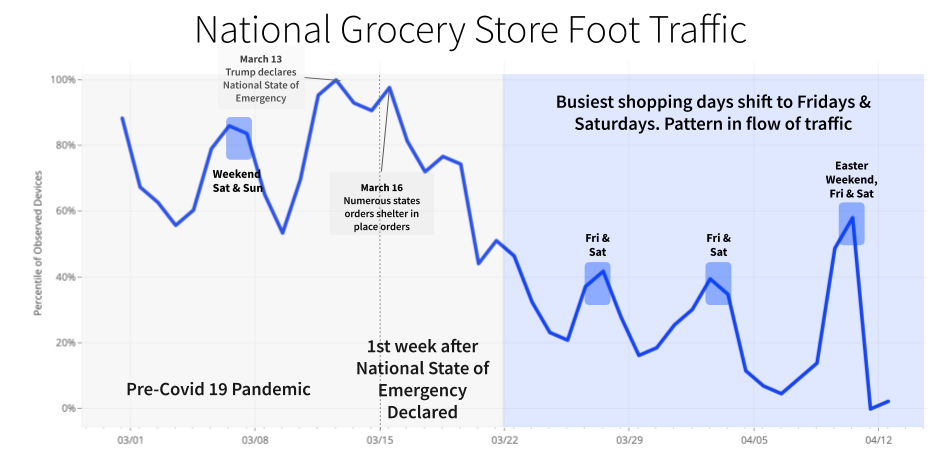

Visitation to grocery stores prior to COVID-19 followed a weekly pattern: the majority of people typically shopped for groceries on Saturdays and Sundays. When President Trump declared a National State of Emergency on March 13, 2020, visitation peaked as people visited stores to stock up on essentials.

After the initial peak in preparedness shopping, some grocery store shoppers returned their weekly shopping cadence, though are now seen shopping on Fridays and Saturdays.

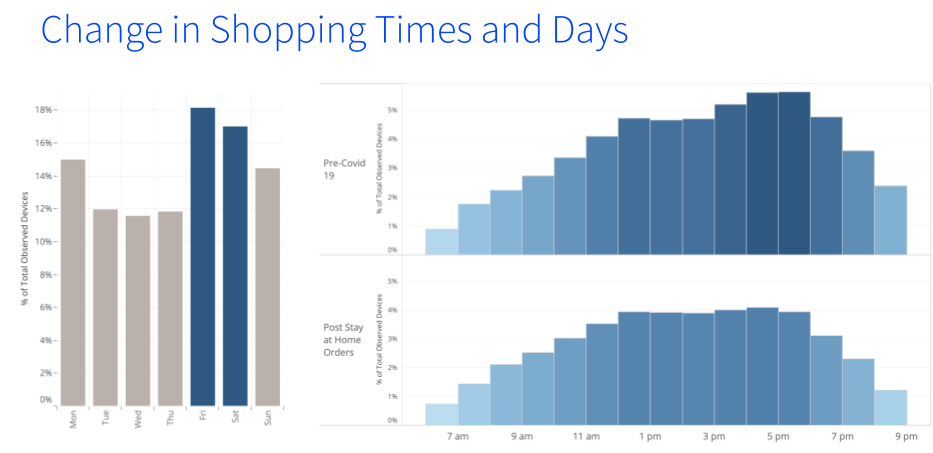

The pre-COVID19 “after work” shopping surge has spread out throughout the day

Prior to COVID-19, the busiest times to shop were typically “after work” between 4pm and 6pm. After COVID-19, visitation has spread out over the course of the day, with fairly even foot traffic between 11am and 6 pm.

Regional grocery store chains are seeing new customers

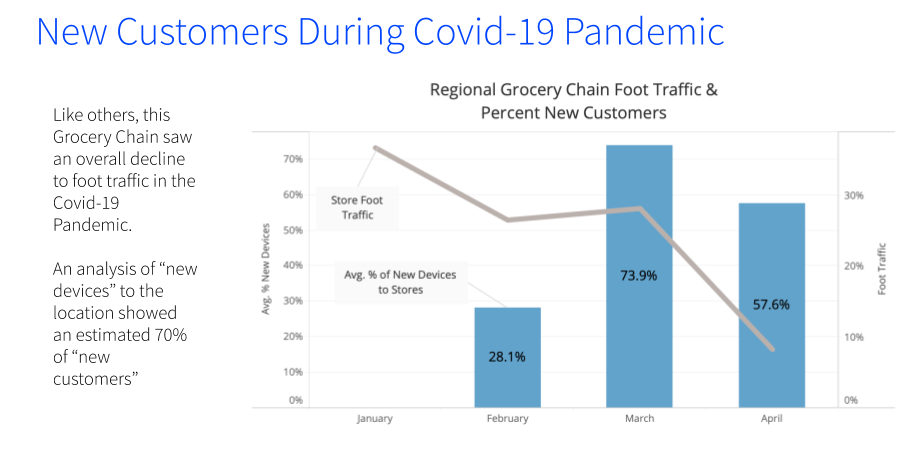

Although visitation to grocery stores during the COVID-19 pandemic is down overall, by looking at the distribution of new vs. existing customers, some brands are actually capturing new customers.

By using this regional grocery store chain as an example, in March, they saw 73.9% new visitors. Our data can be used to help this grocer understand who these new customers are, where they are coming from, and how to best maintain their business after the economy reopens.

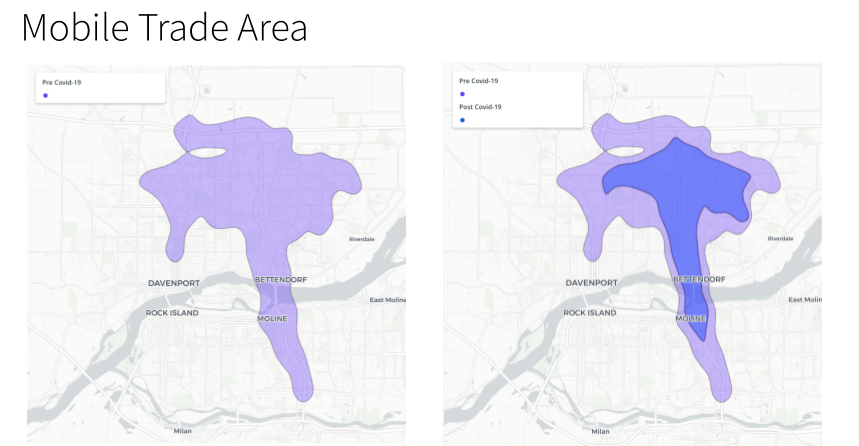

Shoppers aren’t traveling as far to visit a store: trade areas are contracting

Typical consumer behaviors have been disrupted in the last couple weeks, which is evident in the reduction in size of the overall trade area for this location. For example, shoppers who may have stopped by the grocery store on the way home from work are now selecting a store that is closer to home.

Conclusion

We are committed to providing brands and categories as much information as they need to continue to adapt to the spread of COVID-19 and its effect on businesses. In this study, we were able to quantify changes in consumer behavior related to COVID-19 on national, regional, and local levels.

This data is not only useful now to understand the impact of COVID-19 but also help brands prepare as the situation improves in the future.