Key Insights:

Challenge:

- DMM needed real-time insights to keep pace with a rapidly evolving retail landscape.

- Methods like web scraping and radius rings lacked precision and failed to capture true customer behavior.

- DMM required high-quality, reliable data to meet its clients’ needs for actionable insights.

Solution:

- Partnered with B I Spatial to leverage Azira’s mobile data and Claritas insights for advanced shopper analytics.

- Used Precision with Privacy (PwP) tech to create precise trade areas and append PRIZM segmentation while ensuring privacy.

- Provided quarterly mobile traffic insights with detailed visitor demographics and behaviors.

Results at Glance:

- Detailed Shopper Insights: Provided precise answers about trade area reach, customer profiles, visitor demographics, and lifestyle behaviors for shopping centers.

- Actionable Data: Retailers gained tools to improve tenant mix, target marketing efforts, assess tourism traffic, and identify areas for expansion.

- Elevated Decision-Making: ShoppingCenters.com users benefited from data-driven insights for strategic planning, enhancing customer engagement and optimizing retail operations.

“By incorporating Azira data into DMM’s offerings, we created a space for subscribers and licensees to compare thousands of centers in a single, easily accessible, and affordable platform that compares relative volume, visitor traffic, trade area profiles, and geographic reach. No one else is providing anything like it with such precision.”

Introduction

Directory of Major Malls, Inc (DMM) / ShoppingCenters.com., has been a leading source of comprehensive and accurate major shopping center and mall data for more than 35 years. DMM catalogs and updates details on over 9,100 major shopping centers and malls in the U.S. and Canada that have gross leasable areas of approximately 200,000 square feet and up, or are significant specialty lifestyle/mixed-use properties. The database also includes over 16,000 points of interest, covering smaller centers down to 75,000 square feet, and more than 350,000 associated tenant locations. Additionally, DMM provides access to a robust network of 42,565 contacts and maintains detailed data on national and regional chains, as well as independent and local retail stores. Market engagement is facilitated through direct licensing and the ShoppingCenters.com subscription platform.

Challenge

As DMM provides its subscribers with the broadest and most comprehensive major shopping center data available, they were looking for more robust and real-time data enhancements to stay on top of trends in the quickly evolving retail landscape. In addition to DMM’s long-standing relationships with major owners and landlords who directly provide updates and employing alternative hands-on research techniques, DMM was able to elevate the level of analytic data they could provide to their subscription platform and their direct licensing channels. Several supplemental methods often used by other vendors did not meet the quality standards DMM requires to fulfill its commitment to provide highly accurate and comprehensive data to its client base.

Existing traditional methods of expanding DMM’s dataset fell short in a few key ways:

- Web scraping alone provides a one-dimensional view of the current retail, and provides no vantage point into previous or future information such as “Closing” or “Closed” Anchor stores or Anchors “Coming” to a center.

- Radius Rings alone are an imprecise way of assessing activity because rings are not contoured or manually reviewed to exclude non-retail activity locations such as parks, commercial offices and municipal buildings.

- Traditional Manual Traffic Counting does not take into account activity that is in clsoe proximity to a major shopping center, but is not contributing to the consumer activity within the center. Bus stops and commuter parking skew the deeper breakouts and understanding of different types of visitors by time of day, week and seasons.

Identifying a reliable, precise and real time source of information was the only way to help retailers and shopping center operators use DMM’s data to further understand their true customers and make actionable decisions.

Solution

The strategic alliance with B I Spatial allowed DMM to harness the power of Azira and Claritas to get to the next level of shopper insights. B I Spatial was able to use Azira’s mobile data as a catalyst for developing a mobile analytics product and trade areas, for the more than 7,800 major shopping centers and malls in the U.S..

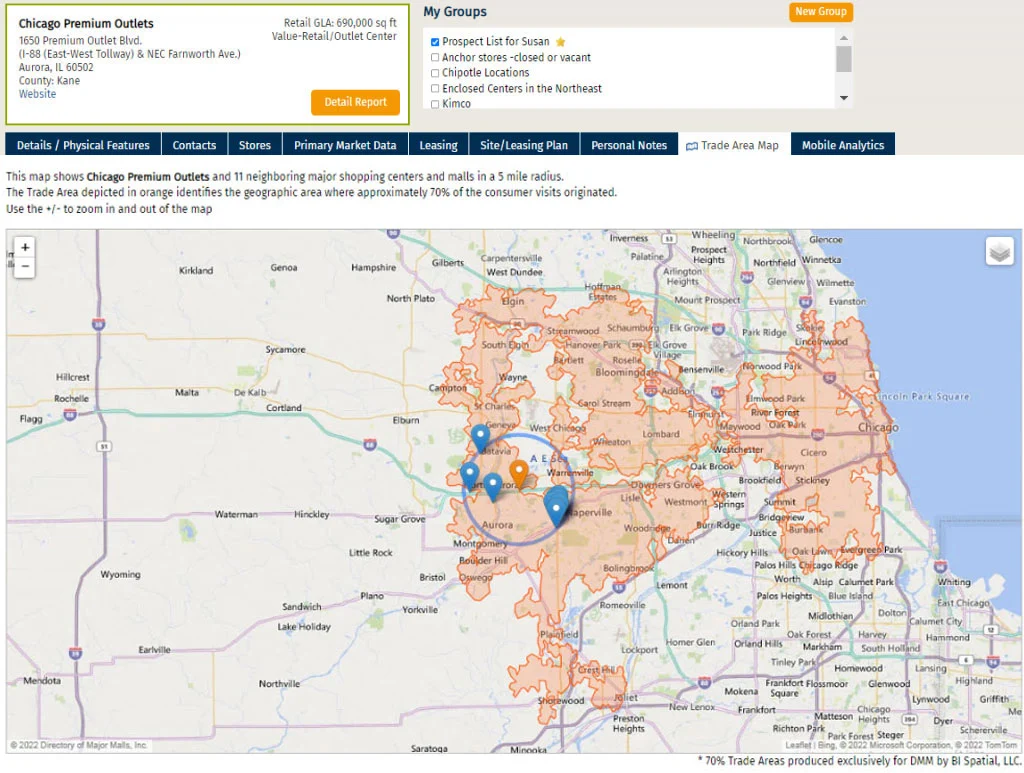

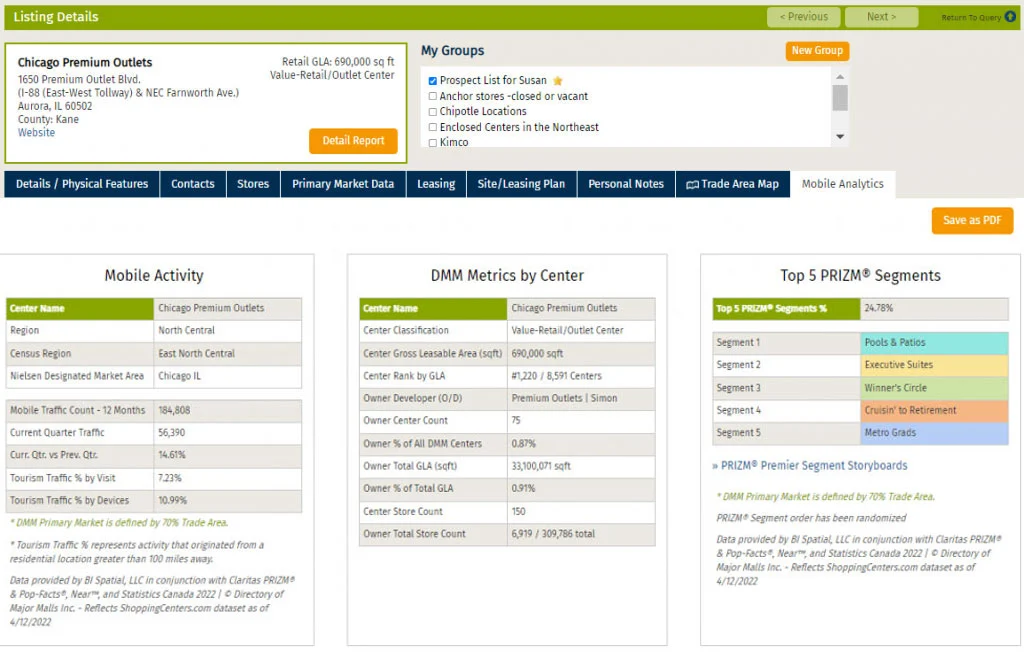

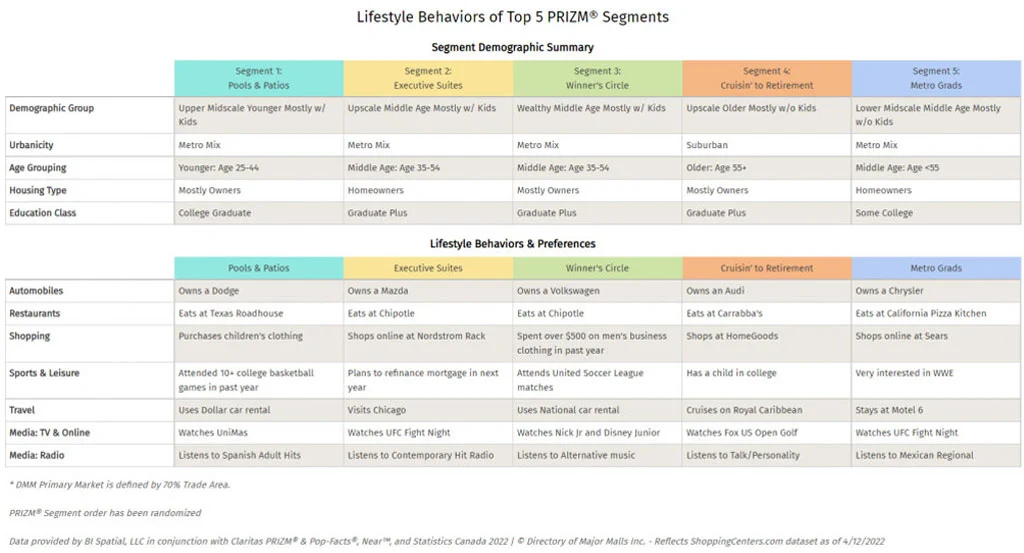

Utilizing B I Spatial’s proprietary Precision with Privacy (PwP) methodology, BIS was able to create very precise Trade Areas and append address-level PRIZM segments to 70+ million Azira devices while maintaining each device’s spatial anonymity. The result yields a quarterly file of mobile traffic observations and unique visits within a 70% trade area along with the top PRIZM segments that contribute to the activity in each center.

DMM’s subscribers now have specific and precise answers to questions like:

- From how far does a center pull?

- Does topography affect the flow of visitors?

- What are the target customer profiles and lifestyle behaviors?

- What are the actual demographics of visitors to the center?

Examples of insights in ShoppingCenters.com enabled by Azira, Claritas and B I Spatial:

Trade area for 70% of the consumer visits to a center in Chicago

Listing details including traffic count using mobile location data

Lifestyle behaviors and demographics of Top 5 PRIZM segments for a center

A retail subscriber to ShoppingCenters.com can elevate their decision-making processes by quickly pinpointing:

- Center and tenant mix metrics

- Precise mobile traffic for 70% trade area

- Tourism traffic flow

- Reliable customer profiles

- Targeted consumer marketing and advertising opportunities

- Areas of potential retail expansion by landlords