A Study of Sydney’s Fitness Enthusiasts

- Anytime Fitness and F45 continue to be the preferred brand in Sydney regardless of limited mobility.

- People aged over 45 years are high risk-takers and visited the gym proportionally more post the reopening than the pre-lockdown phase.

The fitness sector is key to Australia’s economic growth and is not only a source of jobs and investment but also critical to promote mental and physical health as well. Australia is known to rank among the top 15 countries for its high levels of health and fitness.

The pandemic left gyms and sports centers deserted, parks and swimming pools looked sparse, and 50% gym owners saw a 100% decline in revenue. The fear of the virus along with the restrictions has triggered a shift in consumers’ buying patterns more aligned towards online platforms, but did Sydneysiders behave differently when it came to staying fit?

We delved into the historical visitation data during the pre-lockdown phase and overlaid it with real-time location data during the lockdown and after the reopening, and analyzed people visiting sports gyms, public swimming pools, and parks to assess the risk appetite of gym enthusiasts. This in-depth analysis can help gym owners relearn about the consumer segment and push relevant communication to increase customer acquisition.

Gym goers have a high risk-appetite

Deduced by the Texas Medical Association, on a scale of 1 to 9 working out at the gym scores an 8 putting it in the high -risk basket, whereas, swimming in a public pool or going for a walk in the park is a moderately lower risk.

- On studying the frequency of visitation, in the post reopening study period Sydneysiders are most likely to visit the gym at least once and then take a break. This is likely due to people managing their frequent exposure to a high-risk environment.

- There is a 6.4 times higher likelihood of people willing to travel more than 10kms when compared to those traveling 3-5 kms to visit their preferred gym’s franchise in the CBD area. This can be attributed to gym-goers having a subscription at particular gyms, limited availability of slots, or the neighborhood gym being closed.

- Anytime Fitness and F45 continue to be the gym of choice in Sydney. However, since the reopening, the share of visitation has doubled at Jetts, Curves, and Fitness First, whereas Goodlife has seen a dip in footfall.

Fitness continues to be a priority

Upon analyzing, consumer behavior indicates that the road to recovery for the fitness industry is not too rocky. Regardless of the lockdown, gym enthusiasts continued to visit parks and beaches to continue with their fitness regime.

- 1 of 5 people seen visiting a gym in the pre-lockdown period visited outdoor spaces during the lockdown period as well, indicating that fitness has been a priority for this consumer segment regardless of the restrictions.

- People aged above 45 years were willing to take a higher risk than younger age groups.

- 38% of gym-goers visited a gym on the first day of the reopening. The footfall may have gradually dipped as people were trying to manage the exposure to a high-risk environment.

- Even with the limitation of 20-50 people gathering in closed spaces, 34% of customers seen visiting gyms were new customers.

Brands can create lookalike audiences by targeting these ‘new consumers’ and serve them ads with offers and discounts when they are visiting other sports facilities or when in close proximity to their centers.

What does Sydney’s fitness enthusiast look like?

- On comparing the profile of visitors during both periods, Parents and Professionals continue to have a higher share of visitation at gyms than Students and Affluents.

- Post the reopening, there is a visible change seen in the age-group of people visiting gyms as those aged above 45 years hold the larger share of the visitation pie, followed by 18-25-year-olds. Whereas, in the pre-lockdown period Gen Zs visited more, followed by Millennials and Baby boomers aged 26-35 and 45+ years respectively. This shows that fitness has become a priority among the older age group post the pandemic, whereas, people aged between 26-35 years seem to be more risk-averse.

- Sydneysiders preferred to visit gyms, parks, and swimming pools more on the weekends than on weekdays. The busiest time to visit a gym, pool, or park was in the morning.

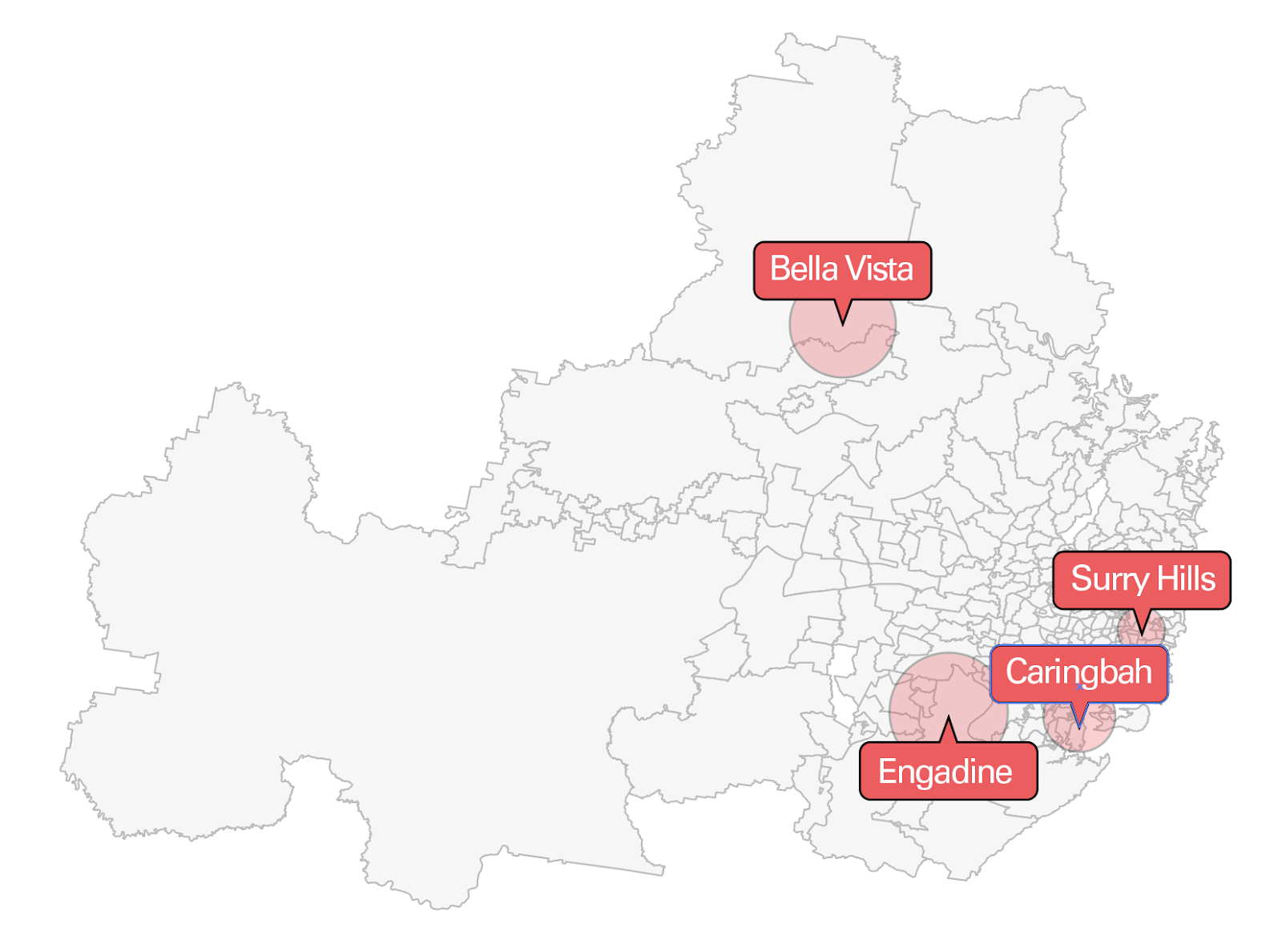

Most active postcodes

- Barangaroo is a busy CBD area in Sydney, and has more than 27 gyms (including nearby areas). Professionals used to frequent them in the pre-lockdown phase, as they were conveniently located near places of work. However, as work from home is more prevalent in the post-reopening period, the gyms in the 2000 postcode do not witness significant footfall.

- The median salary of the most active postcodes after the reopening is 27% more than the median salary of the most active postcodes in the pre-lockdown period. It indicates that the residents living in areas with a higher median salary are willing to take more risks to visit gyms.

Analysis of consumers’ behavior based on real-world signals revealed that as places started to open up the visitation is guided by the risk they are willing to take. Those having a higher risk appetite (risk-takers) are more likely to travel farther distances to visit their preferred brand or do a high-risk activity such as working out at the gym, whereas, those with a lower risk appetite (risk-averse) will prefer to work out at home. Further, the study shows a high inclination for Sydneysiders to stay fit indicating that if the relevant audience is identified, fitness brands will be able to regain their customers and recover.

Studying these visitation trends over longer periods of time can help brands stay relevant and plan for the future. Watch the on-demand webinar to understand how the pandemic has reset consumer behavior and how marketers can effectively engage with these newly evolved consumer segments.

Disclaimer: The data is used to measure the impact on businesses and consumer behavior. If you choose to reuse our analysis, please contextualize it and attribute the content to Azira. Azira’s data platform is privacy-by-design and the data is gathered from real-world signals in an anonymized and aggregated form.