In a time when consumers have more choice at their fingertips than ever before, it is critical that retailers develop strong direct relationships with their customers to earn their loyalty. Retailers have tried different types of loyalty programs for years, such as simple discounts, points, and memberships. Although these programs are not new, they are becoming more important, complex, and increasingly shoppers are saying they base their shopping habits around them.

In Azira’s recent report, The New World of Consumer Behavior: Retail 2022-2023, we surveyed over 1,000 consumers about their shopping behaviors. The importance of loyalty programs bubbled up as one of the key themes.

How shoppers feel about loyalty programs

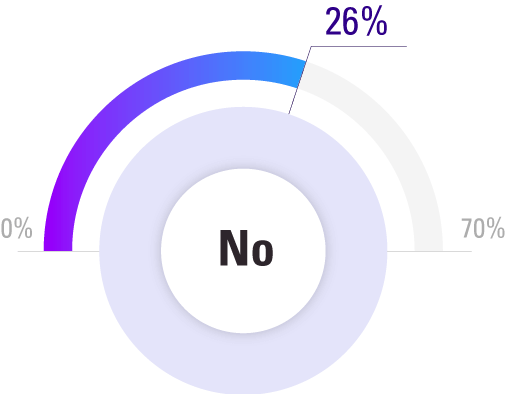

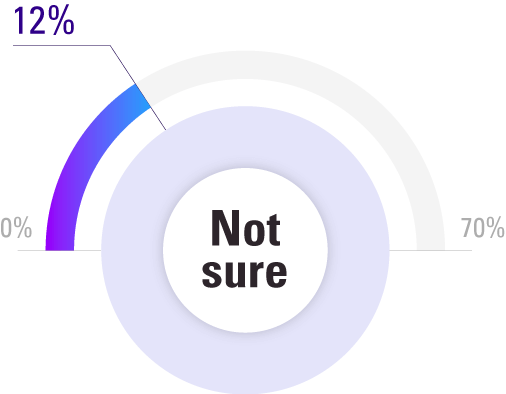

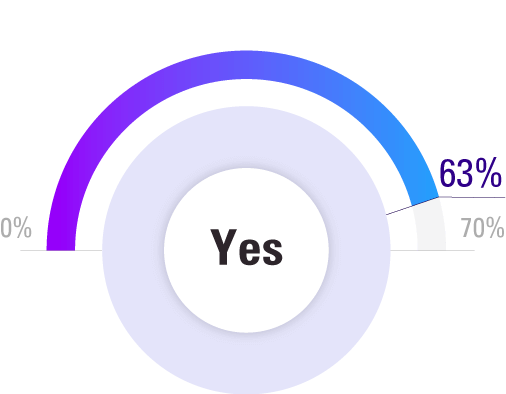

In our survey, 63% of shoppers reported that they visit stores more often when they are a part of that store’s loyalty program or credit card.

Do you visit stores more when you’re a part of their loyalty program?

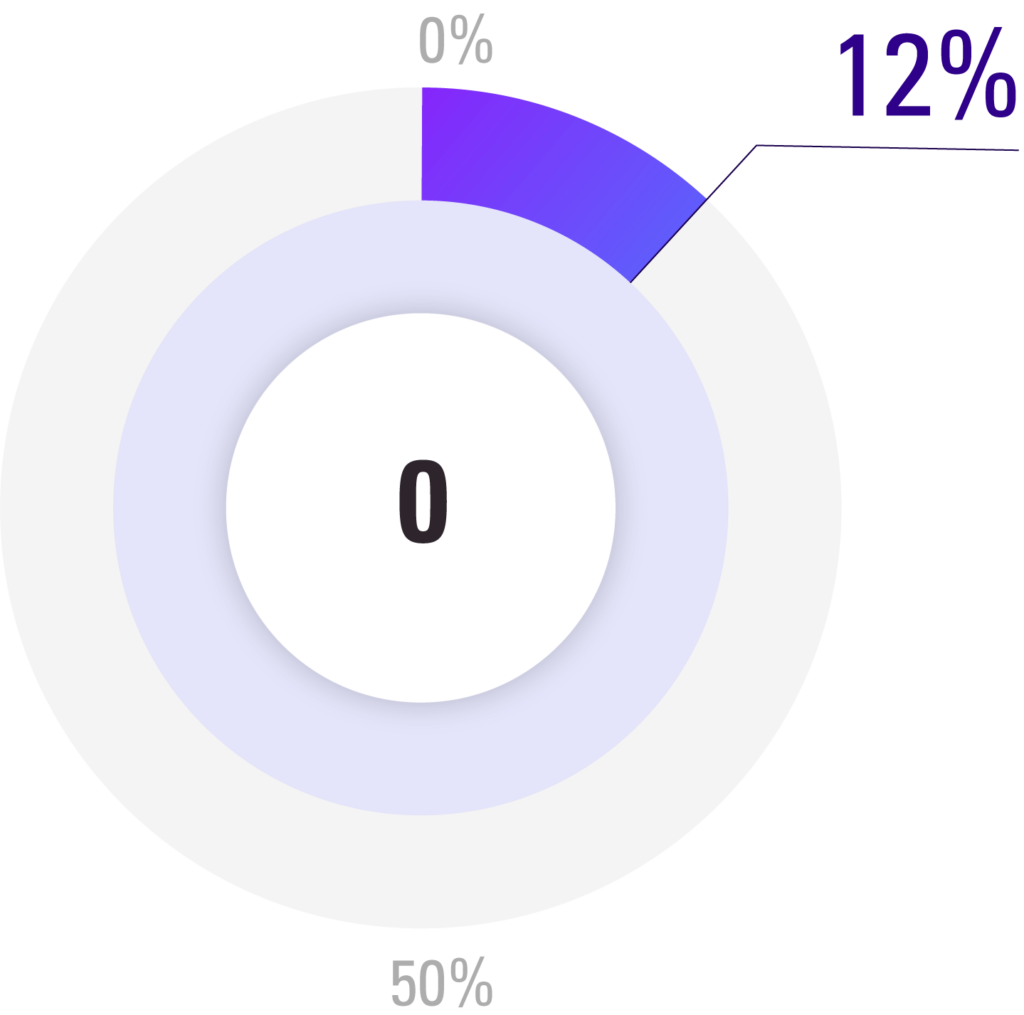

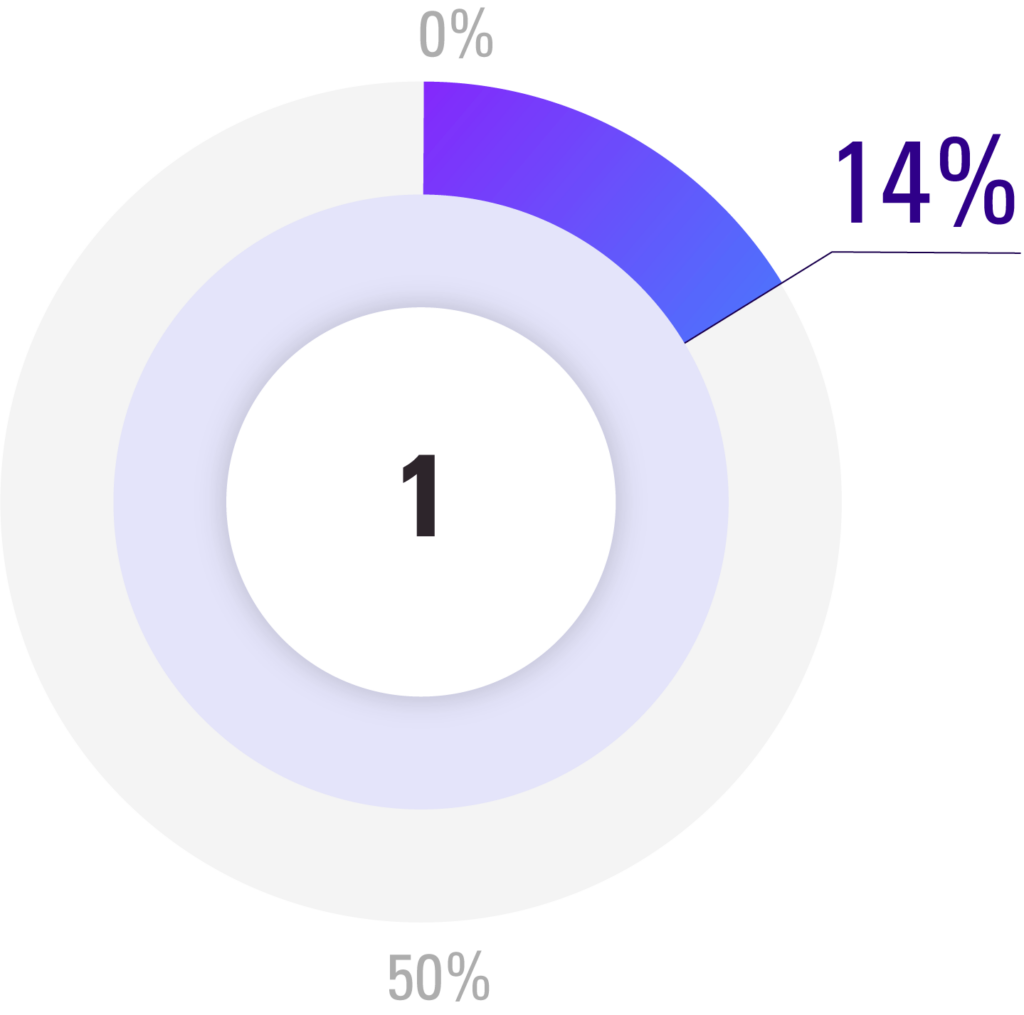

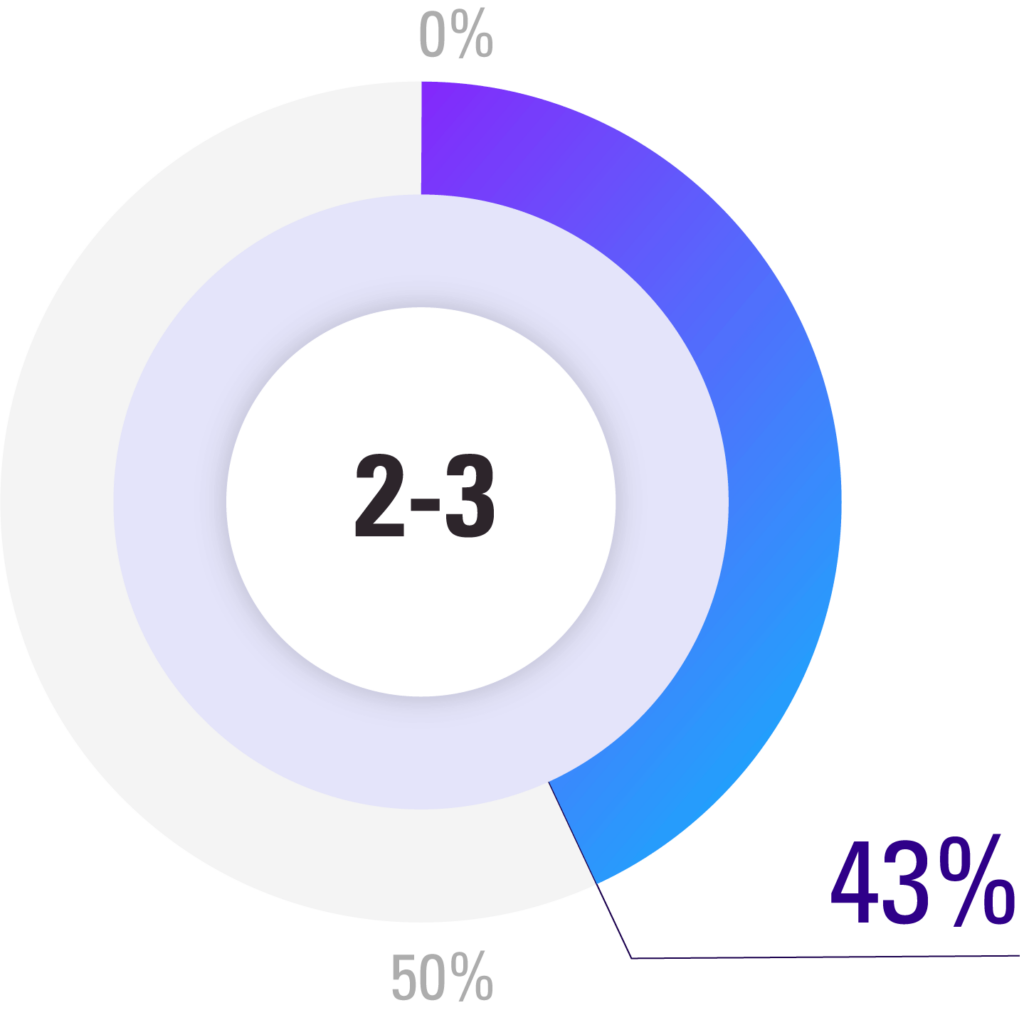

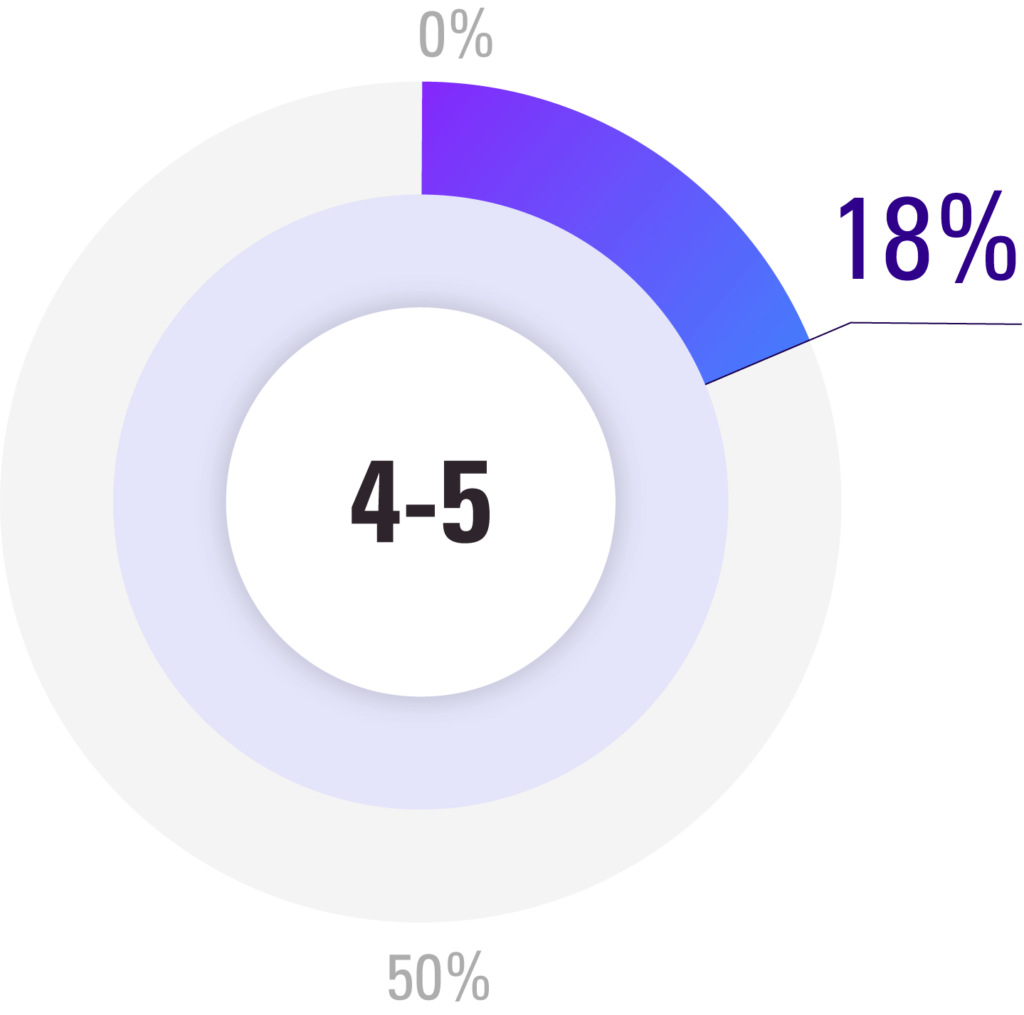

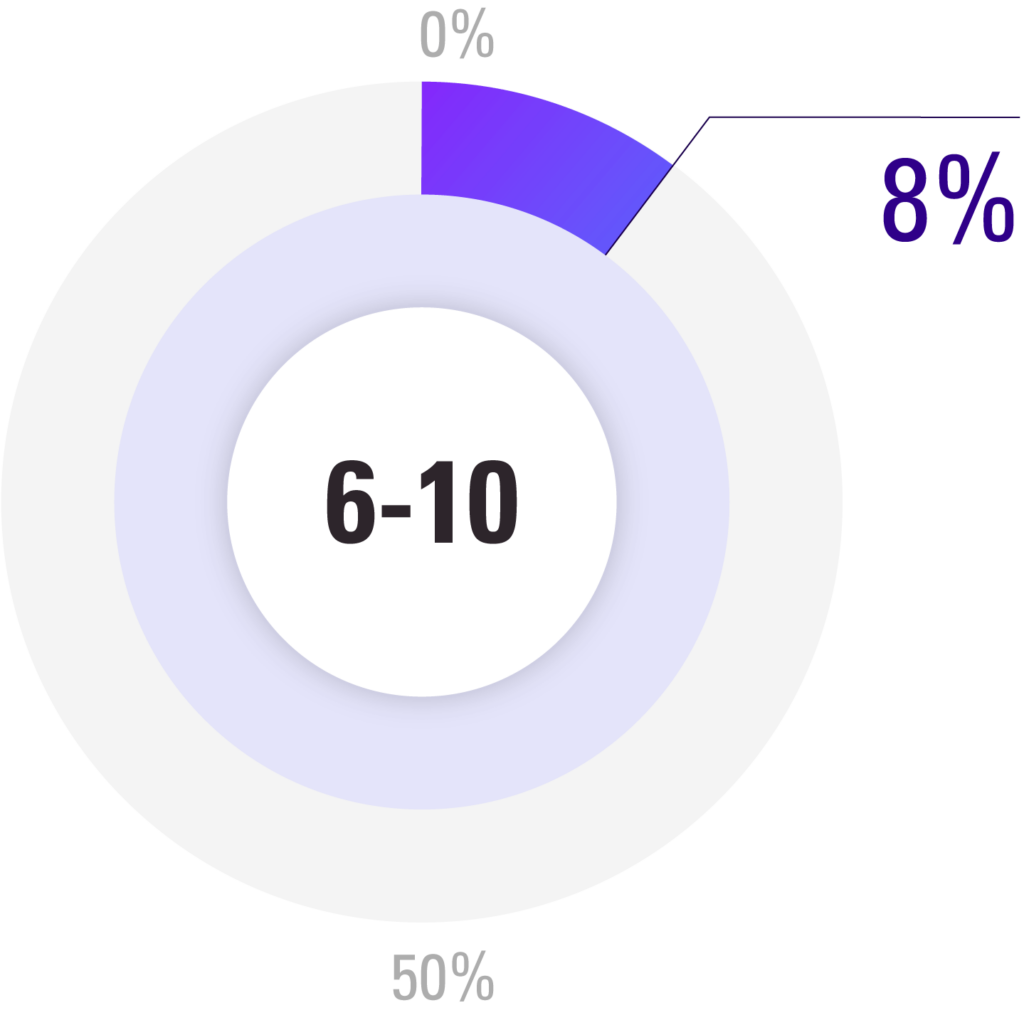

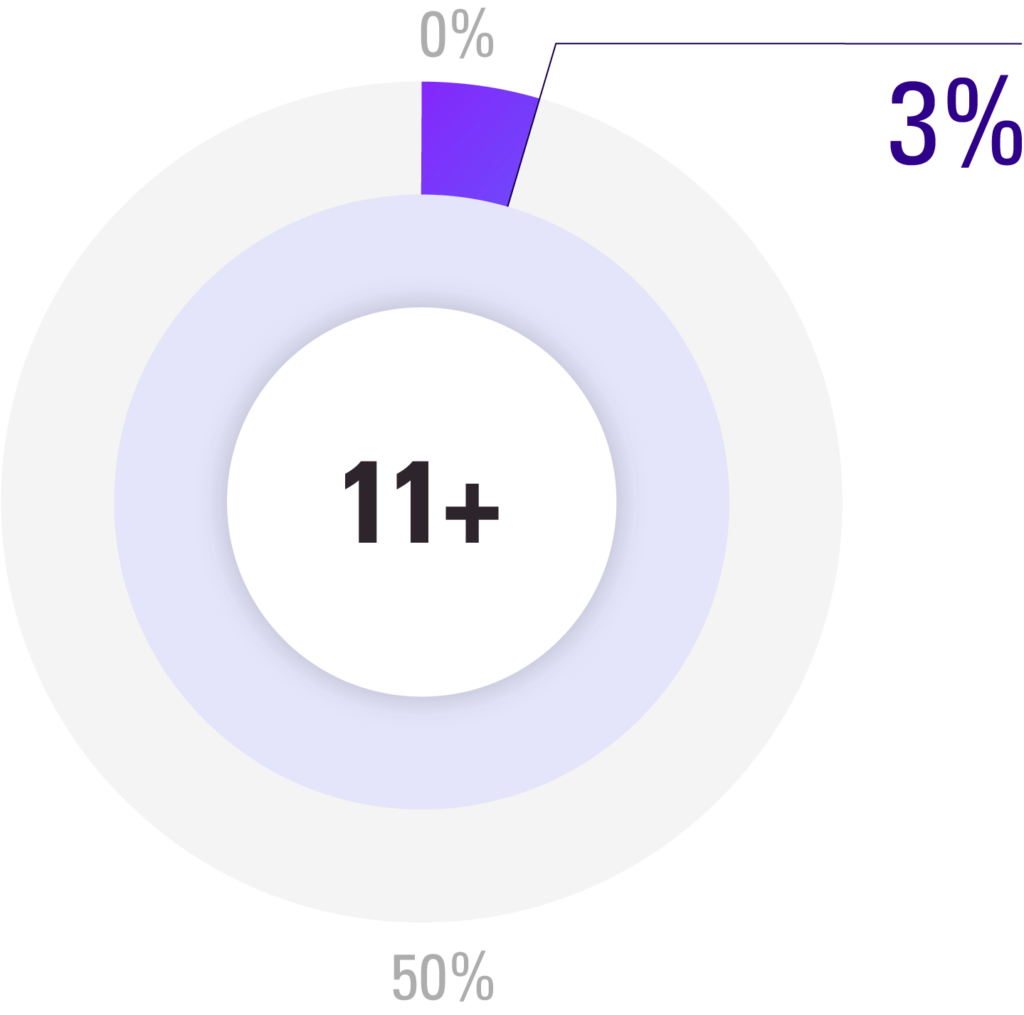

The average shopper is enrolled in 2-3 loyalty programs.

How many loyalty programs are you a part of?

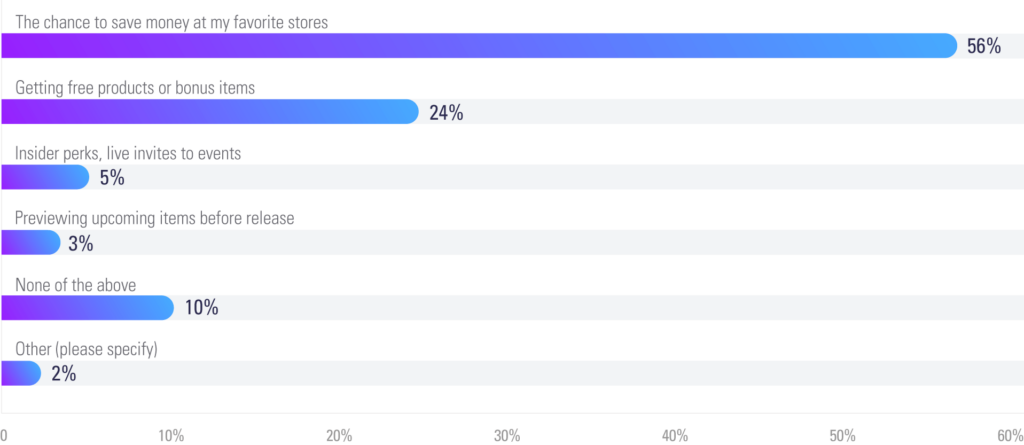

This presents a unique opportunity for retailers to think creatively about how to evolve their loyalty programs. Today’s shoppers are deal hunters and looking for ways to save money, but they are also looking to shop at brands that share their values and offer special membership perks. Despite having more consumer choice than ever before, shoppers are also dealing with choice overload, and are looking to find the few brands they enjoy and connect with.

What motivates you to use store loyalty programs?

Loyalty programs also present a unique opportunity for retailers to build a natural omnichannel journey. When shoppers register at loyalty programs, retailers don’t have to guess what products that shopper wants – they already know. Over time, retailers can use a shopper’s purchase history to personalize the shopping experience through offers, rewards, and recommended products. These programs can be particularly effective when combined with other shopping channels.

How Sephora’s loyalty program drives ROI

Cosmetics-store Sephora started its loyalty program more than a decade ago, and continues to update it to reflect the opportunities afforded by modern technology and also the needs of its customer base. Sephora realized that 80% of their shoppers were using their phones while shopping in stores to supplement their shopping experience, so enhancing the online and in-store experience through a sophisticated app was the next step.

Sephora’s program has many dimensions to it, including free and tiers based on annual purchasing amount, birthday gifts, exclusive access to events, and more. An update to the program in 2020 allowed customers to also redeem loyalty points for discounts or even donate the points to charities. Sephora’s loyalty program also allows them to build an exclusive community. According to studies, emotional perks drive three-quarters of customer engagement.

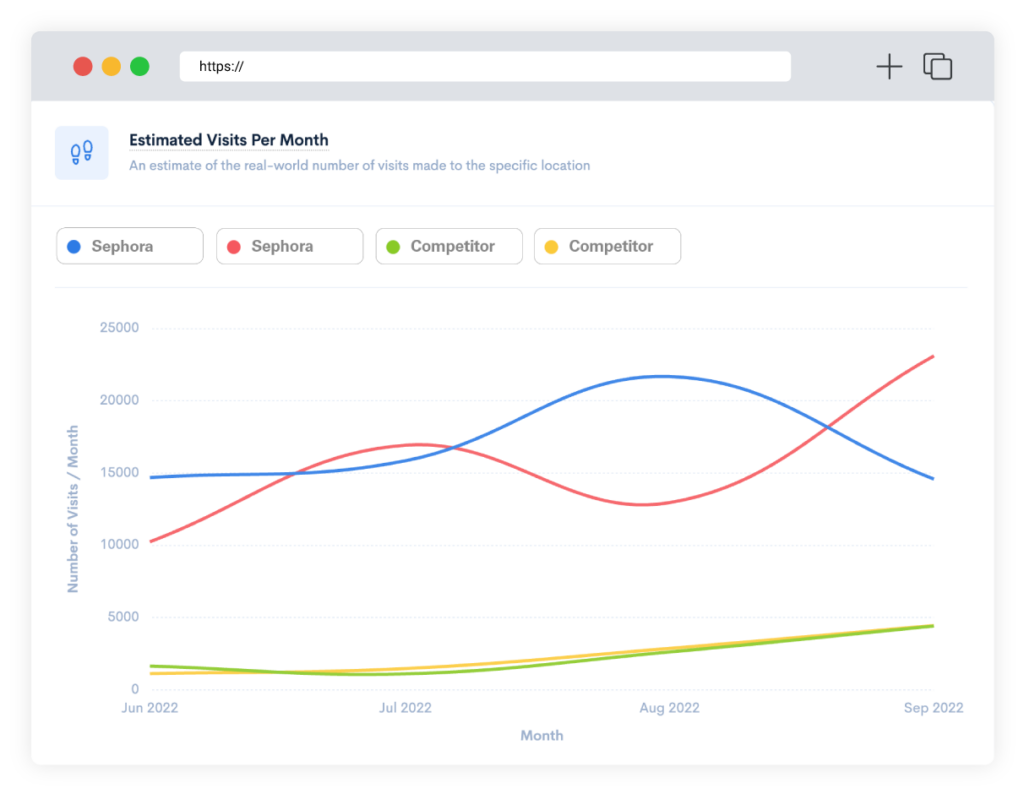

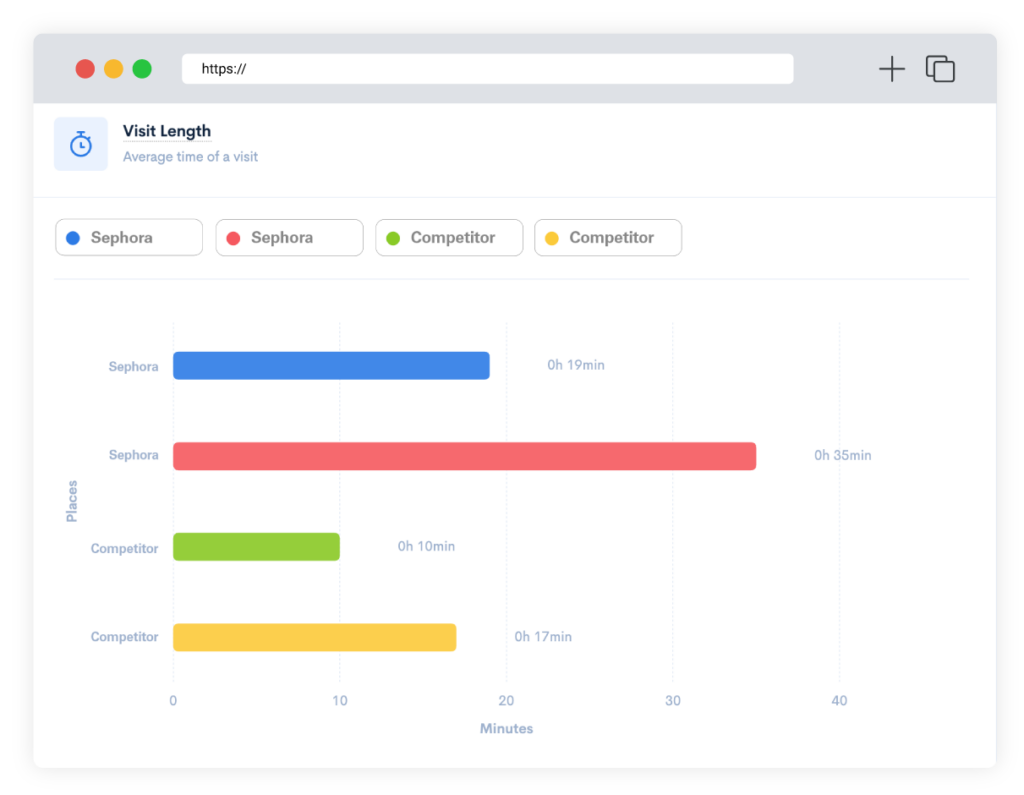

The loyalty program drives clear ROI – members drive 80% of sales while also providing strong, organic publicity to the brand. With human movement data, we can see the strength of Sephora’s loyalty program as part of a broader push to attract customers and keep them coming back. When comparing Sephora’s stores in San Jose, California with its nearest competitors and the average of similar stores, Sephora edges out the competition in terms of footfall, time spent in store, and distance traveled.

While the changing consumer behavior can be seen as a challenge, it’s even more so an opportunity. Top retailers will use data – both their own and third-party data – to invest in loyalty programs and other initiatives to build deeper relationships with their customers. This data-driven approach will help retailers not only provide customers with the quality products they want, but also shopping experiences that delight them.

Study Methodology

Survey conducted August 17-22, 2022 with 634 in the United States and 509 respondents in Australia, Census-weighted by age, gender, income and region.

Azira studied pulled human movement data for retail locations across the United States and Australia, looking at specific locations in the Sydney, Melbourne, Dallas, San Jose and Nashville areas for August 1, 2021 – September 30, 2022. Reports used included Azira Pinnacle’s Estimated Visits, Time Spent, Visitor Home and Work Locations Insights, as well as Azira’s Geosocial Affinity, Estimated Visitors, and Cross-Visitation Reports.