The Symbiotic Relationship that retailers need today.

Retailers across the US have been shutting shop for the last couple of years and the scene is not too different this year. And though such news may not be as alarming to the public anymore, it certainly is every retailer’s nightmare. The reason? Amazon.

For a while now, Amazon has been pushing to acquire the young and affluent (read more here), and trying to bring their existing customers to experience Amazon’s proprietary products, thus explaining the acquisition of Whole Foods.

As an extension of this strategy, Amazon recently rolled out two more initiatives: Partnership with Kohl’s to allow product returns and the launch of it’s own brick and mortar store, Amazon Go. We at Azira, decided to take a look at the initial outcome of these experiments for all the stakeholders involved. Could Amazon also be creating a way for retailers to stay afloat?

The Kohl’s Partnership

In addition to enabling product returns at Kohl’s, Amazon, through this tie-up, also set up pop-up experience stores for in-store customers to experience its home automation product range. Already seeing a huge uproar in Echo sales from the Whole Foods acquisition, Amazon pursued a similar strategy to target a different type of buyer at Kohl’s.

The experiment with Kohl’s began at 10 stores in October 2017 in Los Angeles and Chicago area, where Amazon.com customers were allowed to return products by dropping them off at designated Kohl’s outlets.

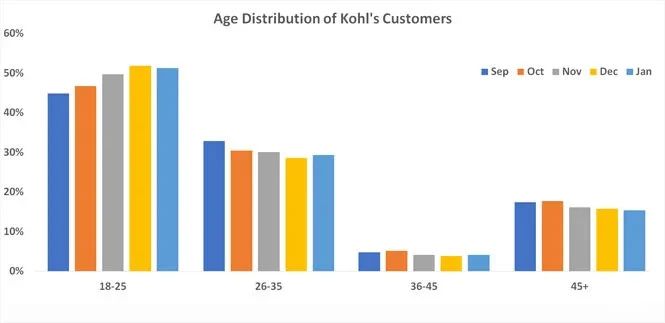

We looked at the change in age distribution of Kohl’s customers at these 10 stores from November to January.

“Indeed, it is the younger customer who is being driven to these Kohl’s stores in over 3 months since the launch of the program.”

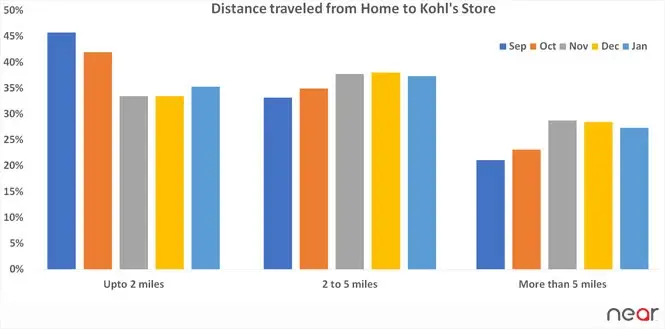

Age wasn’t the only parameter that seems to have gone in favor of Kohl’s. A look at the distance traveled to each of these 10 stores highlights a greater impact.

“More people are traveling further from their homes to visit Kohl’s than before.”

Kohl’s saw a resurgent Q4 FY’18, where sales grew by 6.3% over Q4 for FY’17. Among many things, the increase traffic, both online and offline, factored for the surge in revenue. Of many of the initiatives to drive offline traffic, the tie up with Amazon seems to be working well.

Kevin Mansell, CEO of Kohl’s, had the following comments on the Amazon initiative in the quarterly earnings call — “We really only have one objective here, which is the key priority we have as a company is to drive traffic and ways in which we can innovate and ideate to help improve the trend of traffic we’re open to consider, and this is one of those ideas, and we think it has a lot of merit, as you can tell.”

Amazon GO — Store Launch

On 22 January, 2018 Amazon opened its first automated brick and mortar store to the public. Here is a look at who this store attracted in the first month of its launch:

- 68% of customers were below 35 years of age with 18–25 year old customers among the first to experience the new concept.

- People traveled upto 50 miles to visit the store.

- Being a grocery store, GO impacted the business of Han’s Deli & Grocery, QFC, PCC Natural Market, Safeway, and Albertsons, by poaching customers from these stores.

- Majority of these early customers preferred banking with US Bank and were 2X as likely to get coffee at Caffe D’Arte at Yesler Way, Seattle.

To conclude, Amazon is looking to attract and secure a captivated audience, in an attempt to solidify the foundation for the next stage of its business. Creating experience stores and exposing the younger audience to these experiences is the key to growing business and they’re identifying key segments of the market to achieve the same.

It’s now up to the brick and mortar retailers to learn how to adopt these practices and customize them for their respective businesses. After all, if you can’t beat them, join them!

Contact Us to use data for superior decision-making.

Also published in Medium.