How has COVID-19 and social distancing affected foot traffic to selected retail locations and categories?

Background

As our society changes to adapt to the spread of COVID-19, the shopping patterns of consumers will also likely change. As containment zones, social distancing directives, and shelter in place orders become more prevalent, brands will have to adjust to the changing landscape.

By utilizing Noodles & Company, a regional fast casual restaurant, as a use case for our Brand/Market Impact Study, we analyzed the foot traffic to brand and sector locations over the current day, the previous 7 days, and traffic against the previous month to better understand the impact COVID-19 has had on those locations.

Objective

Our objective is to quantify the impact COVID-19 has on brands and sector categories via mobile location data analysis.

Analysis

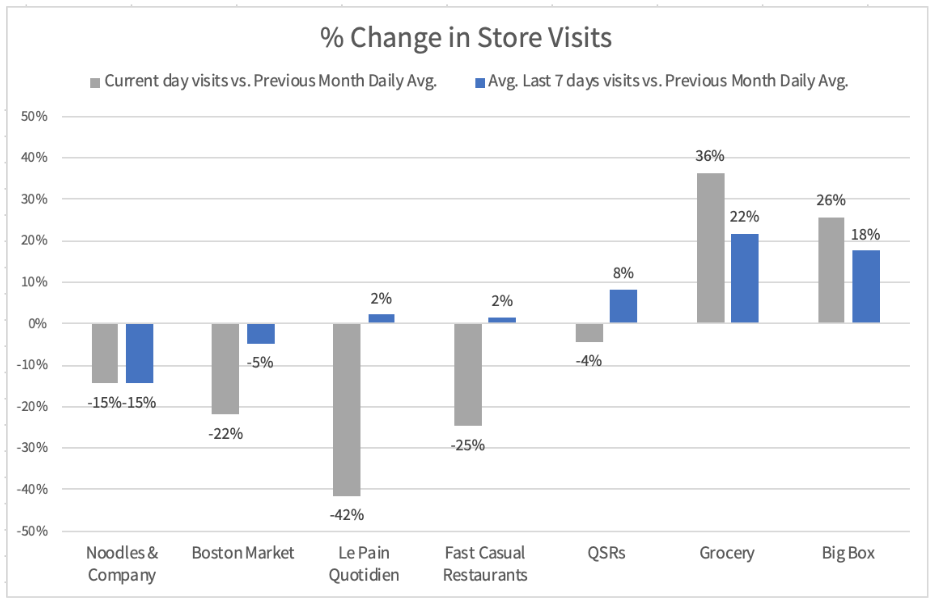

Change in Store Visits – Noodles & Company vs Competitors

We saw that Le Pain Quotidien (LPQ) actually saw a larger drop in visitors compared to Noodles & Company and Boston Market. LPQ has community tables and customers tend to dine in- not surprised to see a lot less traffic there.

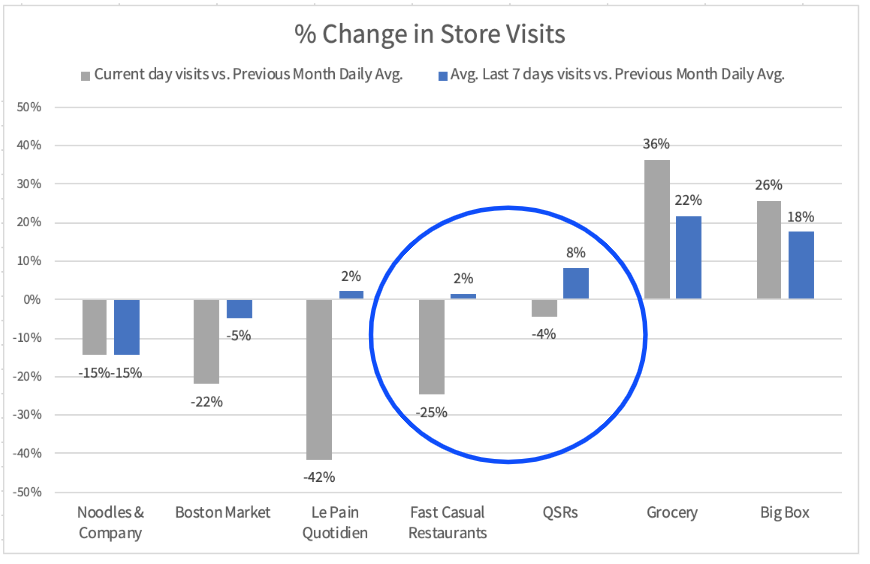

Change in store visits – Fast Casual Restaurants and QSRs

We see a larger drop in fast casual where people might tend to eat in the restaurant. QSRs also typically have drive thrus which facilitates social distancing.

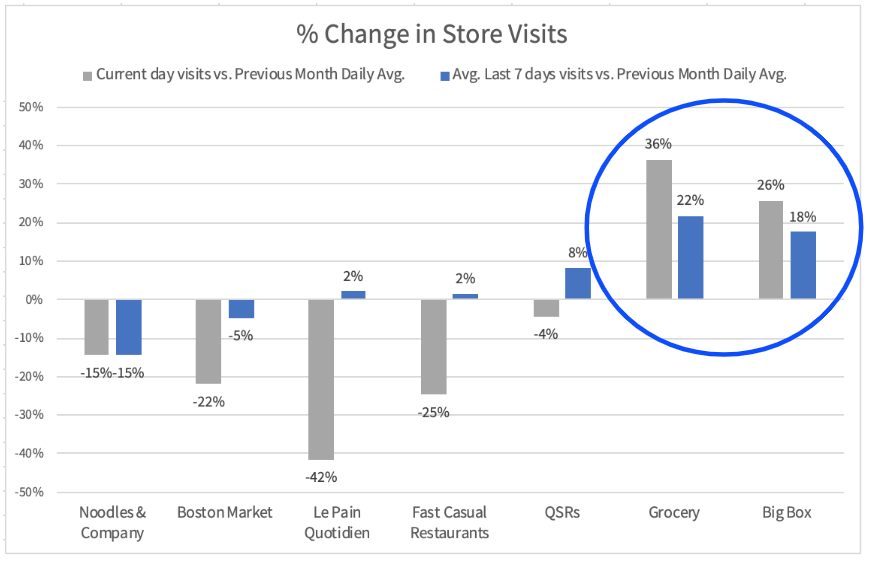

Change in store visits – Grocery and Big Box Stores

In the last 7 days as COVID-19 becomes more prevalent in the United States, we see a jump in visits to grocery and big box stores, presumably as people stock up on supplies.

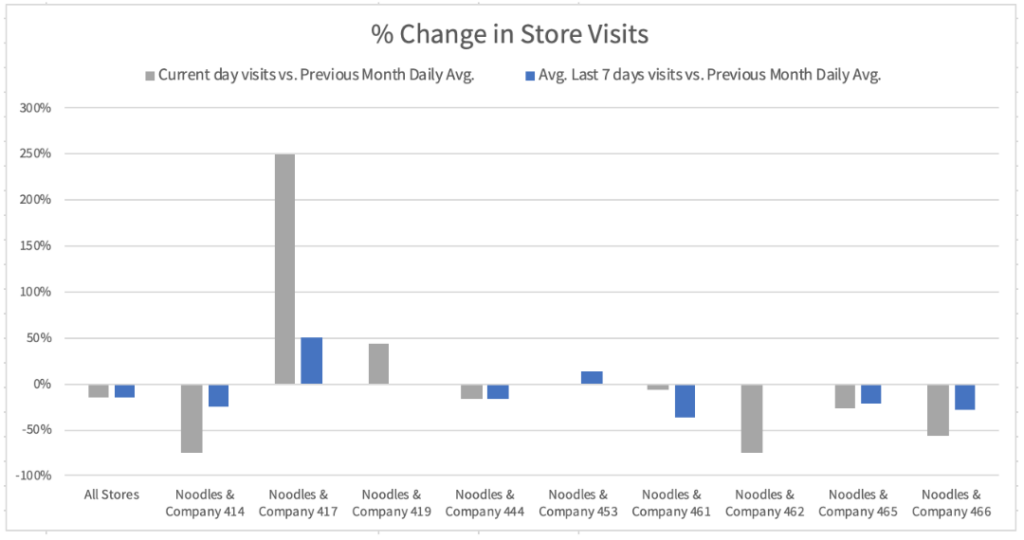

Store-Specific Analysis

Store 417 saw a huge increase. It is located in a big shopping strip mall in a more residential area next to a grocery store. Perhaps people were stocking up on supplies at the store and stopped by that particular Noodles & Company to grab food.

Conclusion

We are committed to providing brands and categories as much information as they need to continue to adapt to the spread of COVID-19 and its effect on businesses. In this study, we saw that businesses better suited for social distancing (drive thrus) or stalking up on essentials (grocery and big box) typically received more foot traffic while people prepare for COVID-19. This brand and sector level data is not only useful now to understand the impact of COVID-19 but also help brands prepare as the situation improves in the future.

Azira copyright notice and disclaimer: No reproduction or use is permitted without Azira’s express written consent.