As the customer journey is increasingly omni-channel, with shoppers fluidly alternating between online and in-store for researching, considering and purchasing products, the shopping experience needs to evolve to reflect this omni-channel reality. Shoppers are motivated to shop online and in-store for specific reasons and at different points in their journey. Ideally, the online and in-store shopping experiences should complement each other to maximize the customer experience overall.

In Azira’s new report, The New World of Consumer Behavior: Retail 2022-2023, we surveyed consumers about their shopping habits to identify 5 trends in shopping behaviors. One of those trends is around how the shopping experience is key, especially to meet omni-channel shopping behaviors.

How shoppers feel about in-store shopping

When shopping in stores, many shoppers report being weary of crowds, stressful shopping experiences, and not being able to find what they want. The actual travel time to a store also weighs on shoppers’ minds.

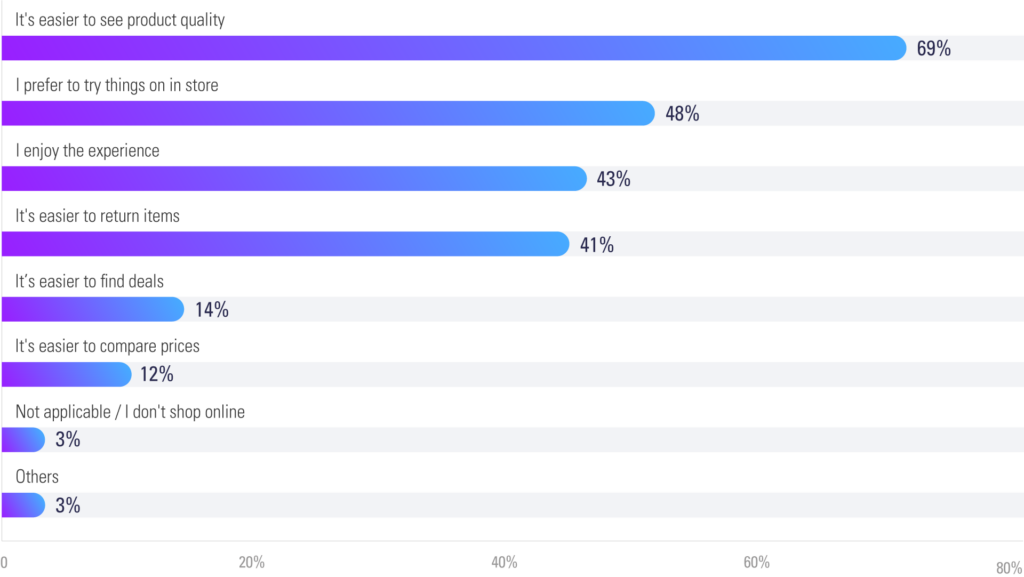

Regardless, many shoppers still make the trip to the store, largely to see a product in person and evaluate its quality, to try it on, or because it’s easier to return items.

Additionally, 43% of shoppers said they’re motivated to go into a store because they simply enjoy the shopping experience. This presents a huge opportunity for retailers to differentiate themselves from the competition and draw footfall to their stores, simply by focusing on elevating the in-store experience and alleviating the previously-mentioned deterrents.

What motivates you to shop in stores? (Select all that apply)

How shoppers feel about online shopping

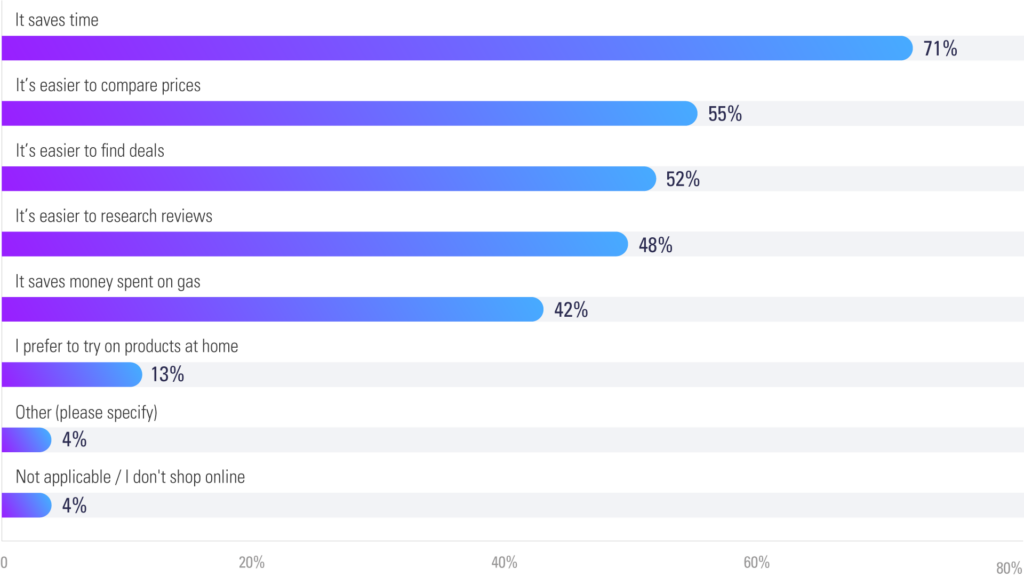

Shoppers responded that the biggest benefit of online shopping is that it saves time. Also important, is that shoppers are able to research many products simultaneously, read and compare reviews, and find good deals.

What motivates you to shop online? (Select all that apply)

When online shopping, how long do you expect shipping to take?

1 Day

2 Days

3 Days

4-5 Days

6-7 Days

8-14 Days

More than 2 weeks

How retailers can create a winning shopping experience

The pros and cons of each shopping experience are unlikely to change, and smart retailers will focus on using and improving both, leaning into each channel’s strength and allowing the shopper to pick and choose based on their needs.

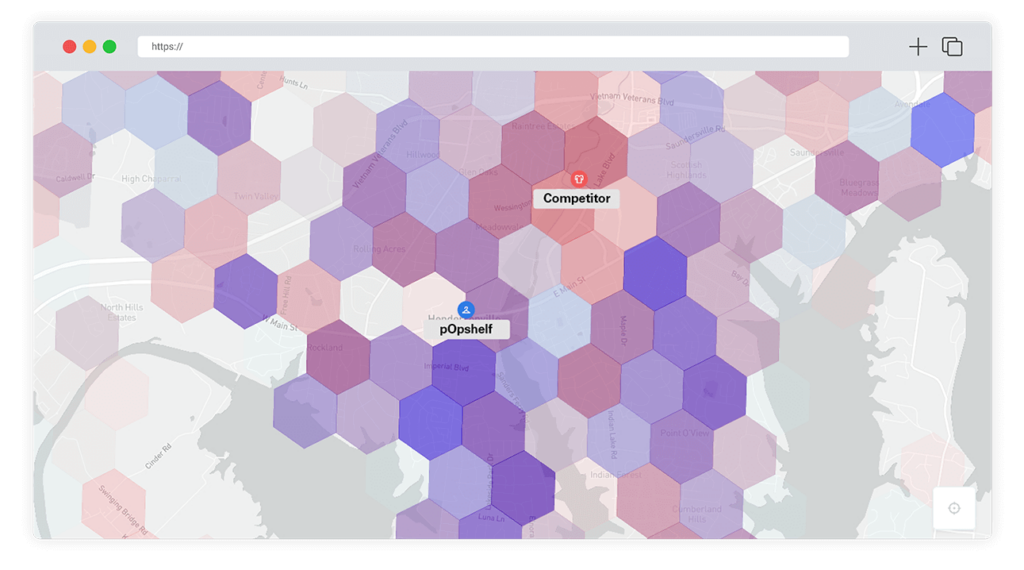

One of the most important components of the shopping experience is the location of the physical store itself. This goes beyond simply choosing popular trade areas with high foot traffic and plenty of parking; strategic site selection requires retailers to open stores in locations that reflect their understanding of their customers and their priorities. Once again, data here is critical, as retailers can use data to understand a trade area’s demographics, its traffic patterns, proximity to stores with similar customer bases, competitive locations, and more. Location data can even help retailers discover precisely which parts of a trade area are most desirable to their customers.

How Dollar General’s pOpshelf launched a winning store experience

In the middle of the Covid-19 pandemic in the fall of 2020, American discount-store chain Dollar General seized an unlikely opportunity. They actually opened a brand new retail chain called pOpshelf. The new chain targeted wealthier shoppers in suburban markets, offering home goods, decor, crafts, and more around a $5 price point. Importantly, they saw an underserved market that desired a pleasant, fun, in-store shopping experience designed around finding bargains for the home. Shoppers have responded, calling it “fancy,” “cute,” and liken visiting pOpshelf to being on a “treasure hunt,” delighting in discovering quality products at bargain prices. pOpshelf’s success is built on leaning into all the motivations shoppers have in wanting to shop in stores. pOpshelf rotates its merchandise to fit seasonal themes, encouraging shoppers to regularly visit and see and touch the products for themselves. It’s an experience that can’t be replicated online.

This success has led Dollar General to announce that they will open 1,000 new stores by the end of 2025. In their initial roll out and expansion, they have carefully chosen pOpshelf locations in wealthier suburbs. In this Nashville suburb of Hendersonville, Tennessee, which has a median household income of roughly $75,000, we can see how one of the first pOpshelf stores entered, and ultimately started to overtake a nearby competitor’s store. The store opened in October 2020, and only a year later, pOpshop was already often seeing more footfall and market share in the area than the nearby competitor.

Retailers should use data – both their own first-party data and also third-party data – to understand who their customers are and what they want. This also positions them best for the future, because customer preferences for how they order and where they shop will change and evolve as the world itself continues to change. When retailers combine global shopping trends with local demographic data, they can make smart choices about site selection, technology infrastructure, and customer service that ultimately satisfies their customer base while building a one-of-a-kind experience.

Study Methodology

Survey conducted August 17-22, 2022 with 634 in the United States and 509 respondents in Australia, Census-weighted by age, gender, income and region.

Azira studied pulled human movement data for retail locations across the United States and Australia, looking at specific locations in the Sydney, Melbourne, Dallas, San Jose and Nashville areas for August 1, 2021 – September 30, 2022. Reports used included Azira Pinnacle’s Estimated Visits, Time Spent, Visitor Home and Work Locations Insights, as well as Azira’s Geosocial Affinity, Estimated Visitors, and Cross-Visitation Reports.