Real-World Data.

Real Business Impact.

Join hundreds of marketers and data leaders who trust Azira’s leading location intelligence platform to grow faster, market smarter, and measure real impact.

The Latest from Azira

Chip

This is some text inside of a div block.

This is some text inside of a div block.

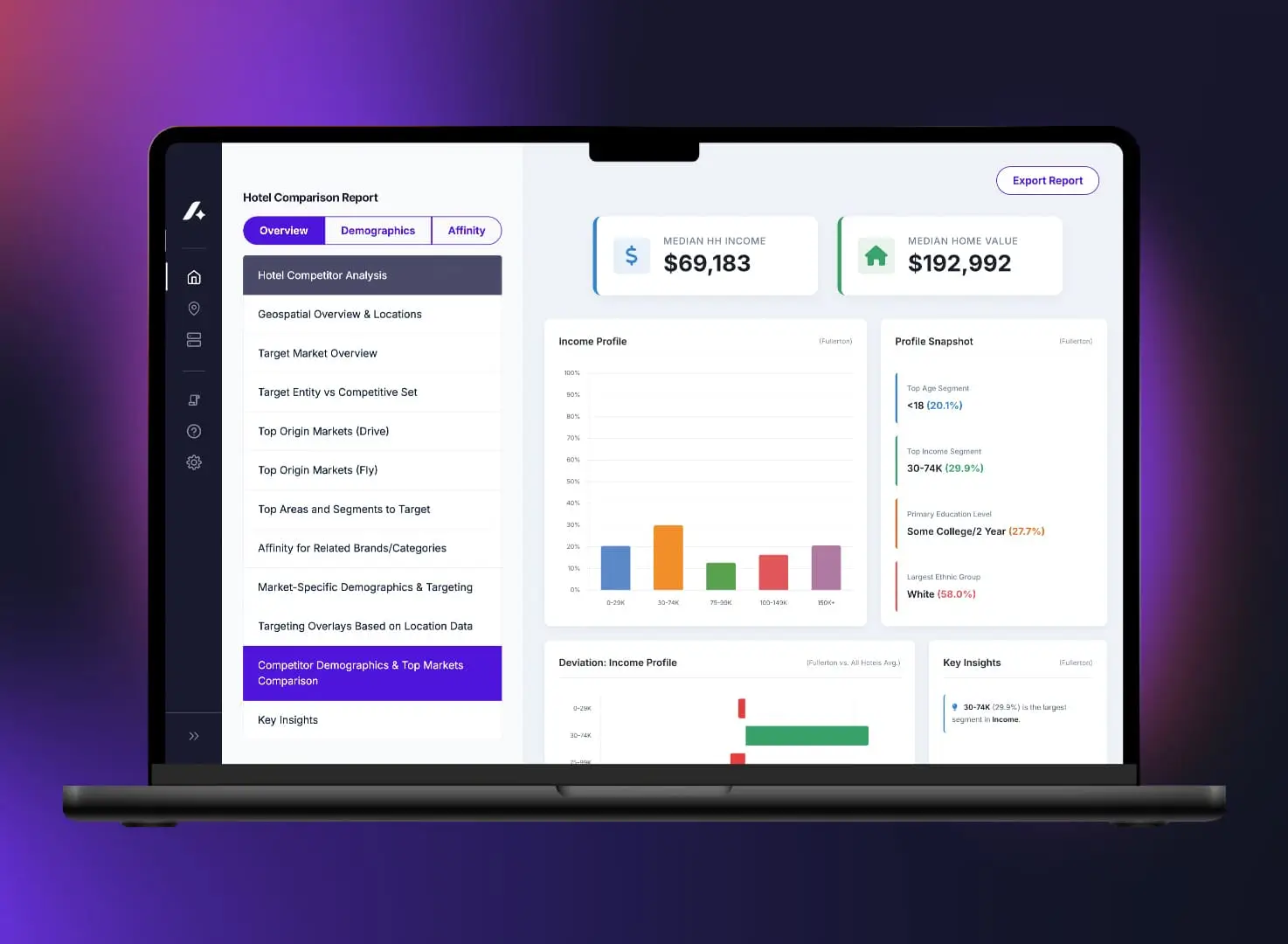

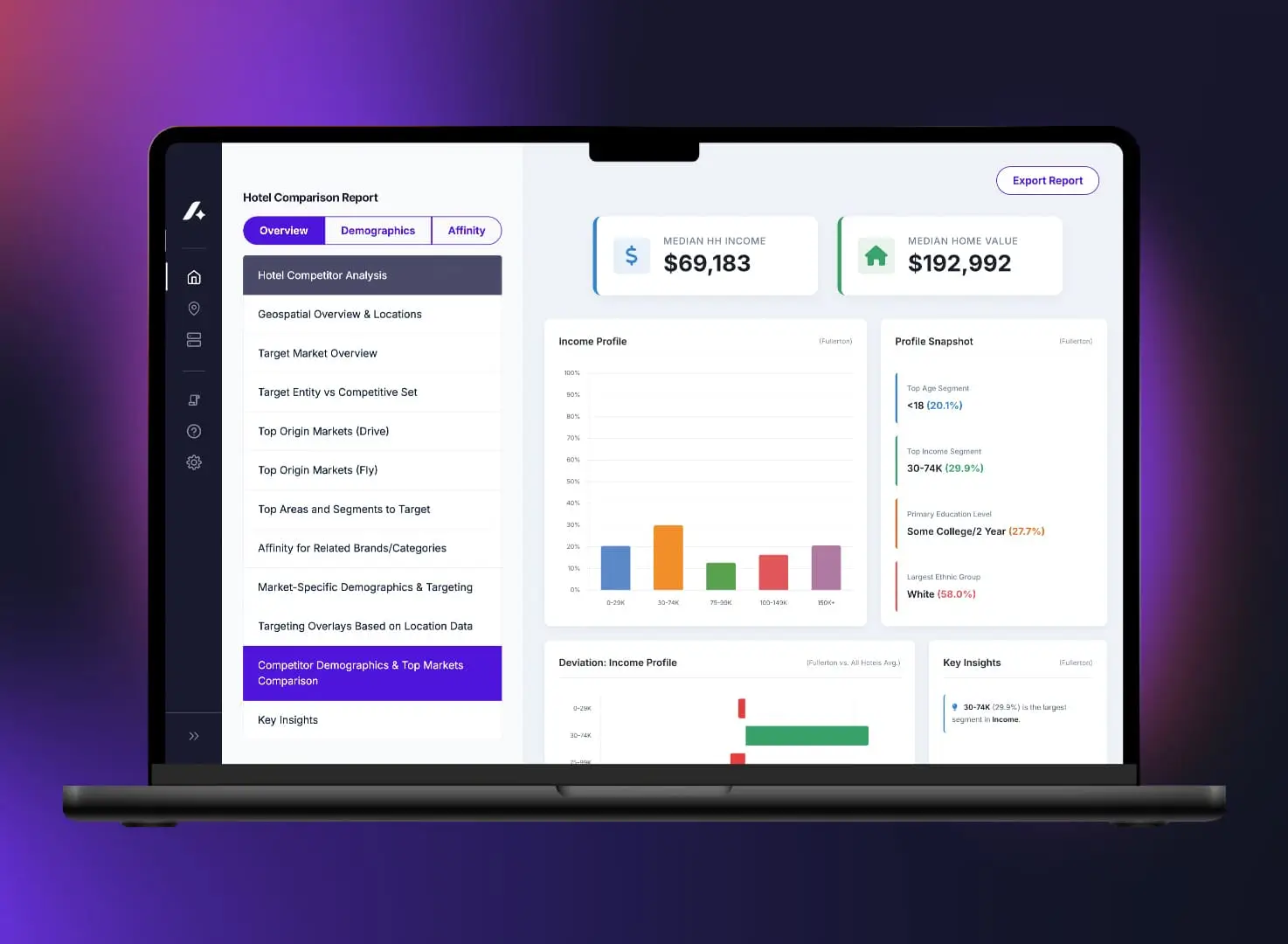

New: Hotel Comparison Report for Hospitality

This is some text inside of a div block.

This is some text inside of a div block.

Azira Launches New Solution Bringing Enterprise-Grade Data to Smaller Hotel Operators

This is some text inside of a div block.

This is some text inside of a div block.

Reflecting on 2025: A Foundation for What’s Next

Make Insight Your Advantage

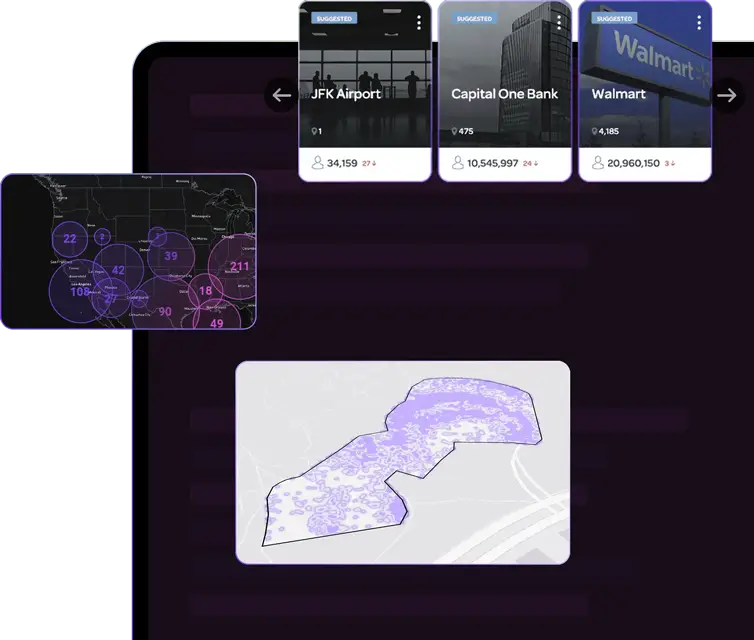

Market Smarter

Marketers and advertisers use Azira to execute top-performing digital campaigns.

Build bespoke audiences based on real-world behavior

Activate on any screen

Enjoy creative services, on the house

Measure Your Impact

Companies trust Azira to measure the real-world impact of their most important investments.

Measure digital campaigns

Track real-world outcomes

Be a boardroom hero

Grow Faster

Businesses and analysts rely on Azira’s data and insights to supercharge their growth.

Understand how people move, shop, and behave

Detect emerging trends

Scope your competition

Trusted by Brands You Know and the Ones You’ll Know Next

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

The Industry Thinks We’re Onto Something

SCHEDULE A DEMO

Ready When You Are

Discover how Azira’s actionable location intelligence can help you achieve your marketing and business goals.